The Single Strategy To Use For Best Broker For Forex Trading

The Single Strategy To Use For Best Broker For Forex Trading

Blog Article

The Best Strategy To Use For Best Broker For Forex Trading

Table of ContentsThings about Best Broker For Forex TradingThe Ultimate Guide To Best Broker For Forex TradingAn Unbiased View of Best Broker For Forex TradingBest Broker For Forex Trading - An OverviewThe smart Trick of Best Broker For Forex Trading That Nobody is Discussing

Because Forex markets have such a large spread and are used by a huge number of individuals, they provide high liquidity in contrast with various other markets. The Forex trading market is frequently running, and thanks to modern technology, is available from anywhere. Thus, liquidity describes the fact that anyone can acquire or offer with a basic click of a switch.Therefore, there is constantly a prospective retailer waiting to get or sell making Foreign exchange a fluid market. Cost volatility is one of one of the most vital aspects that help select the following trading relocation. For temporary Forex traders, rate volatility is important, since it portrays the per hour changes in a possession's worth.

For lasting investors when they trade Forex, the cost volatility of the market is also fundamental. Another significant benefit of Foreign exchange is hedging that can be used to your trading account.

The Best Broker For Forex Trading Diaries

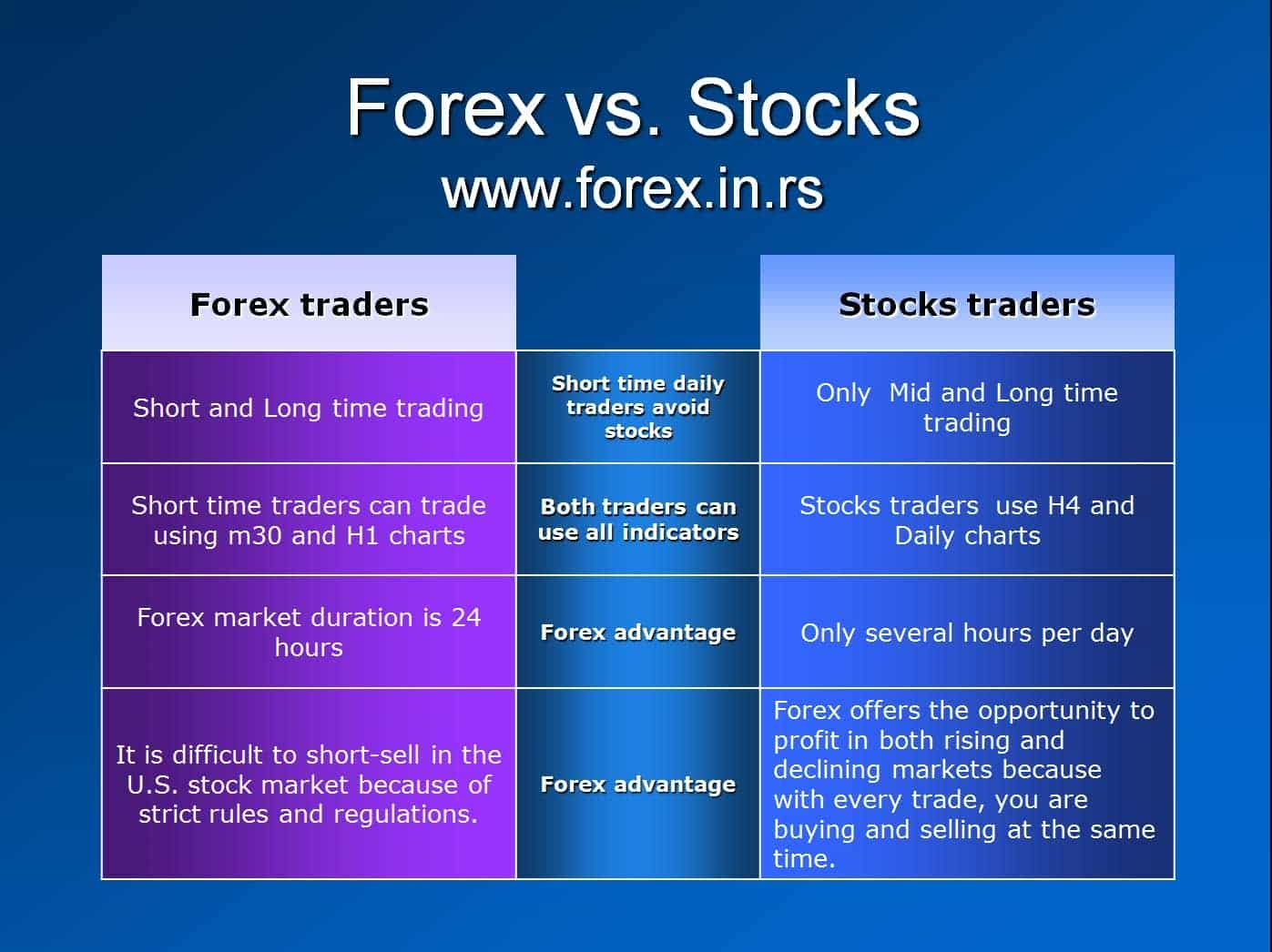

Depending upon the moment and initiative, investors can be split into categories according to their trading style. Some of them are the following: Forex trading can be successfully applied in any of the strategies over. Due to the Forex market's great quantity and its high liquidity, it's possible to enter or leave the market any type of time.

Foreign exchange trading is a decentralized innovation that operates without central monitoring. That's why it is much more prone to fraud and various other types of dangerous tasks such as misleading promises, extreme high danger levels, and so on. Hence, Forex policy was developed to establish an honest blog and honest trading mindset. A foreign Forex broker must conform with the standards that are specified by the Foreign exchange regulator.

Therefore, all the purchases can be made from anywhere, and because it is open 24-hour a day, it can also be done at any moment of the day. For instance, if an investor is situated in Europe, he can trade throughout The United States and copyright hours and monitor the relocations of the one money he is interested in (Best Broker For Forex Trading).

The Definitive Guide to Best Broker For Forex Trading

Many Foreign exchange brokers can provide a really low spread and minimize or even remove the trader's expenses. Investors that pick the Forex market can enhance their income by staying clear of fees from exchanges, down payments, and other trading activities which have additional retail deal prices in the supply market.

There is the opportunity that leverage may increase the size of traders' losses. It offers the option to go into the marketplace with a small budget plan and profession with high-value currencies. Commonly, it is taken into consideration a liability. Some investors may not fulfill the demands of high take advantage of at the end of the purchase. It's feasible to make a smaller initiative and take advantage of high revenue capacity.

Forex trading may have trading terms to safeguard the market individuals, yet there is the danger that somebody may not appreciate the agreed contract. The Foreign exchange market works 24 hours without quiting.

The bigger those ups and downs are, the greater the price volatility. Those big changes can evoke a sense of uncertainty, and sometimes traders consider them as a chance for high revenues.

Some Known Details About Best Broker For Forex Trading

A few of the most volatile currency sets are thought about to be the following: The Foreign exchange market provides a great deal of advantages to any Foreign exchange investor. Once having actually chosen to trade on international exchange, both skilled and newbies need to specify their financial method and obtain acquainted with the terms.

The web content of this article mirrors the author's viewpoint and does not always reflect the main placement of LiteFinance broker. The material released on this web page is supplied for educational purposes just and ought to not be taken into consideration as the provision of financial investment recommendations for the purposes of Directive find out here now 2014/65/EU. According to copyright legislation, this write-up is thought about copyright, which includes a prohibition on copying and dispersing it without authorization.

If your company works internationally, it is necessary to recognize how the value of the united state buck, loved one to various other currencies, can substantially influence the rate of items for united state importers and exporters.

Best Broker For Forex Trading for Beginners

In the early 19th century, money exchange was a major part of the procedures of Alex. Brown & Sons, the initial financial investment bank in the USA. The Bretton Woods Arrangement in 1944 needed money to be pegged to the US buck, which was in turn pegged to the cost of gold.

Report this page